Fraud has evolved. It is faster, more sophisticated, and increasingly digital. Traditional fraud prevention systems struggle to keep up with real-time attacks, insider threats, and complex financial crime networks. This is where AI and blockchain in fraud prevention are becoming essential.

AI brings speed, pattern recognition, and predictive intelligence. Blockchain brings transparency, immutability, and trust. Together, they form a powerful defense system that detects, prevents, and limits fraud more effectively than legacy solutions.

This article explains AI and blockchain in fraud prevention by breaking down how these technologies work together, where they outperform traditional systems, and why this combination is shaping the future of fraud prevention across finance, crypto, healthcare, and enterprise systems.

Why Traditional Fraud Prevention Is No Longer Enough

Most traditional fraud prevention systems rely on:

- Rule-based checks

- Centralized databases

- After-the-fact detection

- Manual investigations

These systems fail because:

- Fraud patterns change rapidly

- Centralized systems are vulnerable

- Insider manipulation is hard to detect

- Real-time prevention is limited

Understanding these weaknesses is key to understanding why AI and blockchain in fraud prevention matter.

What Fraud Looks Like in the Digital Economy

Modern fraud includes:

- Financial transaction fraud

- Identity theft

- Payment and card fraud

- Crypto and DeFi fraud

- Insurance and healthcare fraud

- Supply chain manipulation

Fraud today is cross-border, automated, and often coordinated. Combating it requires intelligence and trust.

Why AI and Blockchain Are Stronger Together

AI and blockchain solve different parts of the fraud problem.

What AI Does Best

- Detects patterns and anomalies

- Learns from historical data

- Flags suspicious behavior in real time

- Adapts to new fraud techniques

What Blockchain Does Best

- Creates tamper-proof records

- Ensures data integrity

- Eliminates single points of failure

- Makes activity auditable and transparent

This complementarity is the foundation of AI and blockchain in fraud prevention.

How AI and Blockchain in Fraud Prevention Actually Work

Let’s break down the real mechanisms.

1. AI Detects Fraud, Blockchain Secures the Evidence

AI systems analyze transactions, identities, and behavior to detect anomalies.

Blockchain:

- Records flagged events immutably

- Preserves evidence integrity

- Prevents post-incident tampering

This ensures fraud data cannot be altered after detection.

2. Real-Time Fraud Detection With Immutable Logs

AI enables real-time monitoring.

Blockchain ensures:

- Every action is recorded

- Logs cannot be deleted or modified

- Investigations rely on trusted data

This combination improves both prevention and prosecution.

3. Decentralized Data Sharing Without Trust Issues

Fraud often spans organizations.

Blockchain enables:

- Secure data sharing between institutions

- Shared fraud intelligence

- No single party controlling the data

AI then analyzes this shared data for cross-platform fraud patterns.

4. Reducing False Positives With AI Intelligence

One of the biggest fraud prevention problems is false positives.

AI improves accuracy by:

- Learning normal user behavior

- Contextualizing transactions

- Reducing unnecessary blocks

Blockchain ensures decisions are transparent and auditable.

5. Identity Fraud Prevention With AI + Blockchain

Identity fraud is a major threat.

AI analyzes:

- Behavioral biometrics

- Usage patterns

- Anomalous access

Blockchain:

- Secures identity credentials

- Prevents identity tampering

- Enables user-controlled identity systems

Together, they dramatically reduce identity-based fraud.

AI and Blockchain in Fraud Prevention Across Industries

Financial Services and Banking

Banks face constant fraud pressure.

AI and blockchain in fraud prevention help by:

- Detecting transaction fraud instantly

- Preventing insider manipulation

- Creating immutable audit trails

Large enterprises and vendors like IBM develop enterprise-grade solutions combining AI analytics with blockchain-based data integrity.

Cryptocurrency and Digital Assets

Crypto fraud includes:

- Exchange hacks

- Rug pulls

- Wash trading

- Fake volume

AI detects suspicious trading behavior, while blockchain ensures transparent transaction histories on networks like Ethereum.

This combination is critical for restoring trust in crypto markets.

E-Commerce and Payments

Online payments are high-risk.

AI and blockchain in fraud prevention:

- Detect abnormal purchase behavior

- Secure transaction records

- Reduce chargeback fraud

Merchants benefit from lower losses and better customer experience.

Healthcare and Insurance

Healthcare fraud is costly and complex.

AI detects:

- Duplicate claims

- Unusual billing patterns

Blockchain:

- Protects medical records

- Prevents data alteration

- Improves claim transparency

This reduces both fraud and administrative overhead.

Supply Chain and Enterprise Fraud

Supply chains are vulnerable to data manipulation.

Blockchain:

- Secures provenance records

- Prevents record falsification

AI:

- Detects anomalies in logistics and inventory data

This combination prevents both financial and operational fraud.

How AI and Blockchain Reduce Insider Fraud

Insider threats are among the hardest to detect.

AI:

- Monitors unusual internal behavior

- Detects access anomalies

Blockchain:

- Records all actions immutably

- Makes misuse traceable

This accountability significantly reduces insider fraud risk.

Fraud Prevention vs Fraud Detection: The Key Difference

Traditional systems focus on detection.

AI and blockchain in fraud prevention enable:

- Early intervention

- Automated blocking

- Preventive controls

Stopping fraud before losses occur is the real advantage.

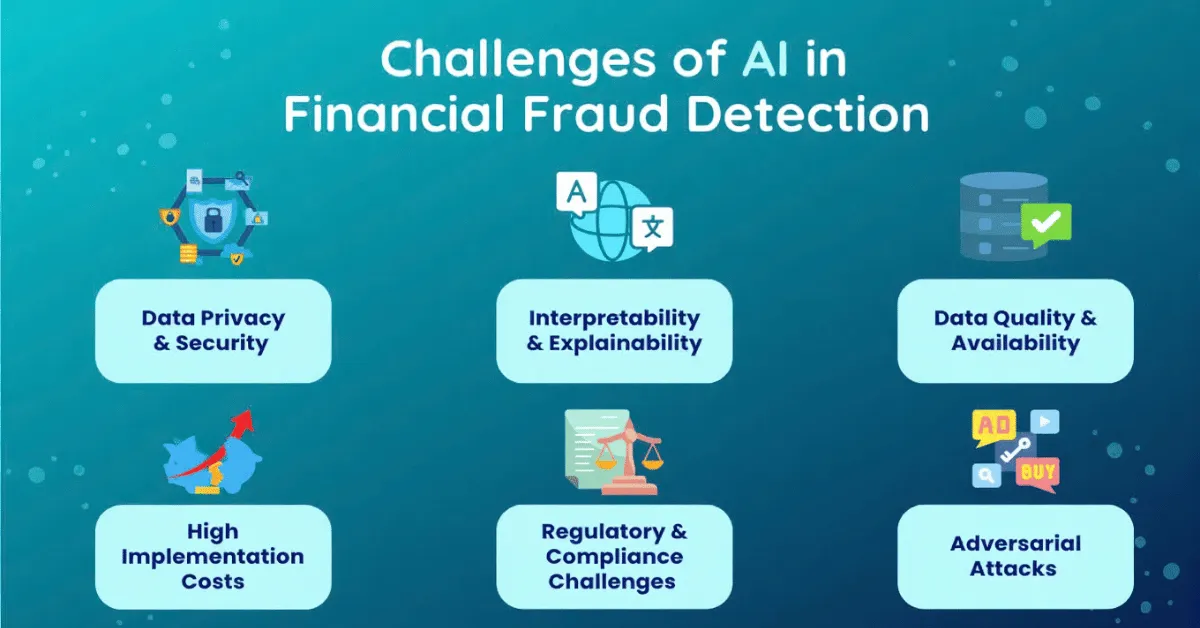

Challenges and Limitations of AI and Blockchain in Fraud Prevention

No system is perfect.

Key Challenges

- Data quality issues

- AI model bias

- Blockchain scalability limits

- Integration with legacy systems

- Regulatory compliance

Successful implementation requires careful system design.

Privacy and Compliance Considerations

Fraud prevention must respect privacy.

Best practices include:

- Off-chain sensitive data storage

- On-chain verification hashes

- Explainable AI models

This balance is essential for legal and ethical adoption.

Why This Combination Is the Future of Fraud Prevention

Fraud is adaptive. Defense systems must be adaptive too.

AI and blockchain in fraud prevention:

- Scale with data growth

- Adapt to new attack methods

- Build trust across institutions

This makes them future-proof compared to static rule-based systems.

What Most Articles Get Wrong

Most content fails because it:

- Treats AI as magic

- Treats blockchain as storage

- Ignores enterprise realities

- Avoids discussing trade-offs

Fraud prevention is a system design problem, not a tool problem.

Frequently Asked Questions

How do AI and blockchain work together in fraud prevention?

AI detects suspicious behavior, while blockchain secures records and ensures data integrity.

Is blockchain necessary for fraud prevention?

Not always, but it significantly improves trust, auditability, and resistance to tampering.

Can AI and blockchain prevent all fraud?

No system can prevent all fraud, but this combination greatly reduces risk and impact.

Final Conclusion

So, what is the real role of AI and blockchain in fraud prevention?

AI brings intelligence, speed, and adaptability. Blockchain brings trust, immutability, and transparency. Together, they create fraud prevention systems that detect threats earlier, prevent manipulation, and preserve reliable evidence.

Fraud will never disappear.

But systems built on AI and blockchain make it far harder, riskier, and less profitable.In a digital world where trust is constantly tested, AI and blockchain are becoming the new foundation of fraud prevention.