The financial services industry is undergoing its biggest structural transformation in decades. Traditional systems built on manual processes, centralized databases, and fragmented infrastructure are no longer sufficient for a global, digital economy. This is where AI and blockchain in financial services are reshaping how money moves, risk is managed, and trust is established.

Artificial intelligence adds intelligence, prediction, and automation. Blockchain adds transparency, security, and decentralization. Together, they are not just improving financial services. They are redefining them.

This article provides a complete, in-depth analysis of AI and blockchain in financial services, explaining how they work together, where they deliver the most value, and why this combination is becoming foundational for modern finance.

Why Financial Services Need AI and Blockchain

Financial services face persistent challenges:

- Fraud and financial crime

- Slow settlement and reconciliation

- High operational costs

- Data silos and poor transparency

- Regulatory pressure and compliance complexity

AI and blockchain address these problems at the system level rather than through incremental fixes.

Understanding the Roles: AI vs Blockchain in Finance

Before exploring their combined impact, it’s important to understand their individual roles.

Role of AI in Financial Services

AI excels at:

- Pattern recognition

- Predictive analytics

- Automation

- Real-time decision-making

It turns raw financial data into actionable intelligence.

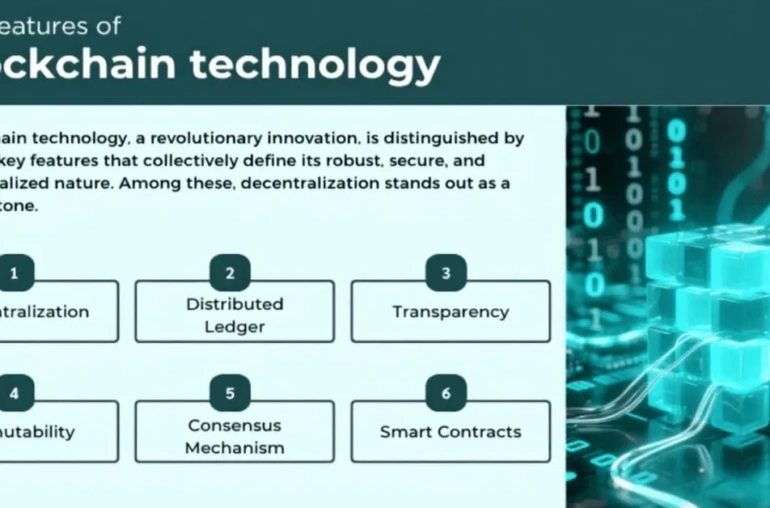

Role of Blockchain in Financial Services

Blockchain provides:

- Immutable transaction records

- Decentralized trust

- Transparent audit trails

- Secure data sharing

It creates a reliable, tamper-proof financial infrastructure.

The real power emerges when these two technologies are integrated.

AI and Blockchain in Financial Services: How They Work Together

The combination of AI and blockchain creates a financial system that is:

- Intelligent

- Secure

- Transparent

- Adaptive

This synergy is what makes AI and blockchain in financial services transformative rather than incremental.

1. Fraud Detection and Prevention

Fraud is one of the biggest costs in finance.

AI:

- Detects anomalies in transactions

- Learns evolving fraud patterns

- Flags suspicious behavior in real time

Blockchain:

- Stores transaction records immutably

- Prevents data tampering

- Preserves forensic evidence

Together, AI detects fraud while blockchain ensures the integrity of the data used to investigate it.

2. Payments and Cross-Border Transactions

Traditional cross-border payments are:

- Slow

- Expensive

- Opaque

Blockchain improves payments by:

- Enabling near-instant settlement

- Reducing intermediaries

- Increasing transparency

AI enhances this by:

- Optimizing routing

- Predicting liquidity needs

- Managing foreign exchange risk

This combination significantly improves global payment systems.

3. Risk Management and Credit Assessment

Risk assessment is central to financial services.

AI improves risk management by:

- Analyzing large datasets

- Predicting default probabilities

- Monitoring real-time exposure

Blockchain supports this by:

- Providing verified financial histories

- Preventing data manipulation

- Improving model reliability

This leads to more accurate, fair, and dynamic risk evaluation.

4. Compliance, KYC, and AML Automation

Regulatory compliance is costly and complex.

AI automates compliance by:

- Monitoring transactions for suspicious activity

- Detecting money laundering patterns

- Reducing false positives

Blockchain enhances compliance by:

- Securing identity records

- Creating auditable trails

- Enabling shared compliance infrastructure

This significantly lowers compliance costs while improving regulatory confidence.

5. Smart Contracts and Financial Automation

Smart contracts automate financial agreements.

Blockchain:

- Executes contracts automatically

- Ensures terms cannot be altered

- Removes intermediaries

AI enhances smart contracts by:

- Monitoring conditions

- Optimizing execution timing

- Detecting abnormal behavior

On networks like Ethereum, this enables fully automated, intelligent financial workflows.

6. Trading, Asset Management, and Market Analysis

Financial markets generate massive data volumes.

AI improves trading by:

- Analyzing market patterns

- Optimizing portfolio allocation

- Managing volatility

Blockchain supports this by:

- Providing transparent transaction histories

- Reducing settlement risk

- Improving post-trade reconciliation

Together, they improve market efficiency and trust.

7. Tokenization of Financial Assets

Tokenization is a major innovation.

Blockchain enables:

- Digital representation of assets

- Fractional ownership

- Faster settlement

AI enhances tokenization by:

- Pricing assets dynamically

- Managing liquidity

- Assessing market risk

This expands access to financial markets while improving efficiency.

8. Data Security and Privacy in Finance

Financial data is highly sensitive.

Blockchain improves data security by:

- Preventing unauthorized modification

- Eliminating single points of failure

- Enhancing transparency

AI enhances security by:

- Detecting breaches

- Monitoring abnormal access

- Predicting cyber threats

Together, they create a more resilient financial data ecosystem.

Enterprise and Institutional Adoption

Major institutions are already adopting this combination.

Banks, insurers, and fintech firms use AI and blockchain in financial services to:

- Reduce operational costs

- Improve customer experience

- Strengthen compliance

- Increase scalability

Companies like IBM develop enterprise-grade platforms combining AI analytics with blockchain infrastructure.

Role in Decentralized Finance (DeFi)

DeFi is a direct product of blockchain.

AI enhances DeFi by:

- Managing liquidity

- Detecting protocol risk

- Preventing manipulation

This makes decentralized financial systems more stable and trustworthy.

Regulatory Perspective on AI and Blockchain in Financial Services

Regulators focus on:

- Consumer protection

- Financial stability

- Data integrity

Blockchain improves regulatory visibility, while AI improves oversight efficiency. This combination aligns well with future regulatory frameworks.

Challenges and Limitations

Despite the benefits, challenges remain.

Key Challenges

- Integration with legacy systems

- AI model transparency

- Blockchain scalability

- Governance of automated systems

Successful implementation requires careful system design and oversight.

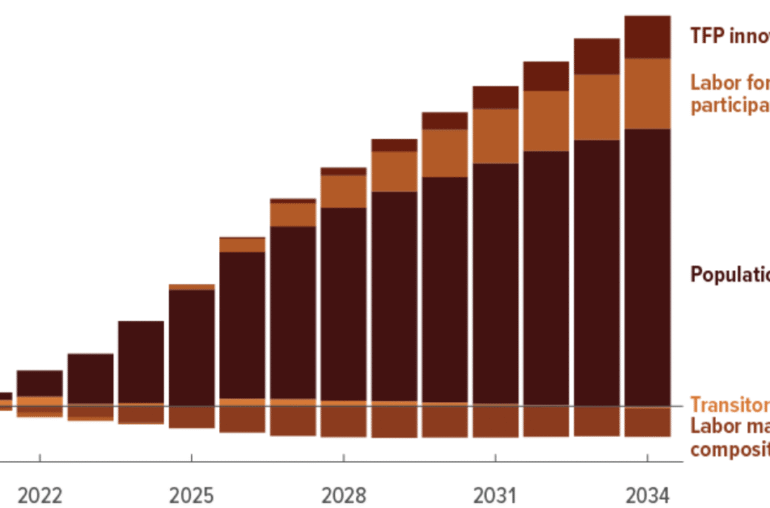

Why This Combination Is the Future of Finance

Finance is becoming:

- Data-driven

- Automated

- Global

- Always-on

Static, centralized systems cannot keep up. AI and blockchain together provide the intelligence and trust required for next-generation financial services.

What Most Articles Get Wrong

Most content fails because it:

- Treats AI and blockchain separately

- Focuses only on use cases

- Ignores regulation and risk

- Avoids enterprise realities

The transformation is architectural, not cosmetic.

Frequently Asked Questions

How are AI and blockchain used together in financial services?

AI analyzes and predicts financial behavior, while blockchain secures data and transactions.

Are AI and blockchain replacing banks?

No. They are transforming how financial institutions operate.

Is this technology only for crypto?

No. Traditional finance increasingly uses AI and blockchain for core operations.

Final Conclusion

So, what is the real impact of AI and blockchain in financial services?

AI brings intelligence, automation, and adaptability. Blockchain brings trust, transparency, and security. Together, they create financial systems that are faster, safer, more efficient, and more resilient than anything built before.

This is not about replacing finance.

It is about rebuilding it on better foundations.

As financial services evolve, AI and blockchain will no longer be optional innovations.

They will be core infrastructure.

And the institutions that adopt them intelligently will define the future of finance.