In the dynamic world of finance, understanding what is the OTC market and how it works is essential for investors, traders, and financial professionals. The OTC market, or over-the-counter market, represents a decentralized trading ecosystem where securities like stocks, bonds, derivatives, currencies, and even cryptocurrencies are exchanged directly between parties without a central exchange. Unlike traditional stock exchanges such as the NYSE or NASDAQ, the OTC market operates through broker-dealer networks, offering flexibility but also introducing unique risks and opportunities. This article delves deep into the OTC market definition, its mechanics, types, tiers, advantages, disadvantages, regulations, trading processes, global variations, emerging trends, and more. By exploring OTC trading, OTC stocks, pink sheets, broker-dealers, market makers, counterparty risk, liquidity issues, and regulatory frameworks, you’ll gain a thorough understanding to navigate this alternative marketplace effectively. Whether you’re curious about how to trade OTC securities or comparing OTC vs exchange-traded markets, this guide covers cluster topics like OTC derivatives, OTC bonds, OTC forex, and future innovations to help you outrank conventional knowledge.

OTC Market Definition: Breaking Down the Basics

The OTC market stands for over-the-counter market, a decentralized platform where financial instruments are traded directly between two parties, often facilitated by broker-dealers or market makers. Unlike centralized exchanges, there’s no physical location or automated matching system; trades occur via phone, email, or electronic networks. This setup allows for customized contracts, making it ideal for non-standardized securities.

Key elements of the OTC market definition include:

- Decentralization: Trades happen off-exchange, reducing oversight but increasing flexibility.

- Participants: Includes institutional investors, hedge funds, banks, and retail traders.

- Assets Traded: Encompasses OTC stocks, OTC bonds, OTC derivatives (like swaps and forwards), foreign currencies (OTC forex), and emerging assets like cryptocurrencies.

Understanding what is the OTC market starts with recognizing its role in providing access to securities that don’t meet exchange listing requirements, such as small-cap companies or foreign issuers. This market handles trillions in notional value annually, with OTC derivatives alone reaching $693 trillion in 2013 and showing continued growth into 2026.

History of the OTC Market: From Phone Trades to Digital Networks

The OTC market has evolved significantly since its inception in the early 20th century. Initially, trades were conducted over the phone or in person, hence the term “over-the-counter.” The 1930s saw the establishment of the National Quotation Bureau, which published “pink sheets” for unlisted stocks—a precursor to modern pink sheets.

Post-World War II, the market expanded with OTC derivatives in the 1980s, fueled by technological advancements and globalization. The 2008 financial crisis highlighted risks in OTC derivatives, leading to reforms like the Dodd-Frank Act, which mandated central clearing for certain contracts. By the 1990s, electronic platforms like OTC Link emerged, digitizing trades and improving efficiency.

In recent years, the OTC market has integrated blockchain and AI, with OTC crypto trading mirroring traditional structures in decentralized finance (DeFi). This historical context explains how the OTC market works today, blending tradition with innovation— a topic often overlooked in standard guides.

How the OTC Market Works: Mechanics and Processes

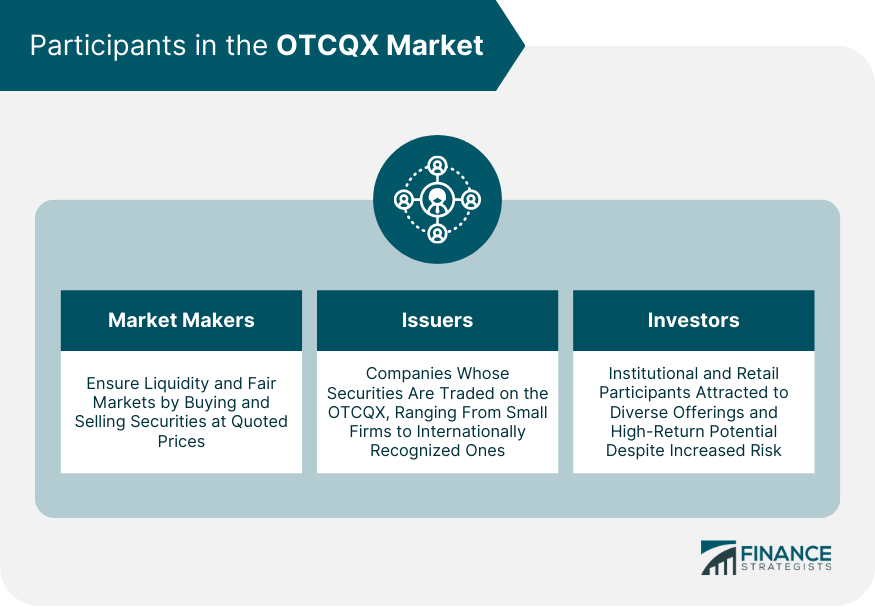

At its core, how the OTC market works involves direct negotiations between buyers and sellers, mediated by broker-dealers who act as market makers by quoting bid and ask prices. Trades are executed bilaterally, with prices determined by supply, demand, and negotiation rather than automated systems.

Key Processes in OTC Trading

- Quote Publication: Market makers post prices on platforms like OTC Link or Global OTC.

- Negotiation: Parties agree on terms, including price, quantity, and settlement.

- Execution and Settlement: Trades clear through private agreements or central counterparties for derivatives.

- Reporting: Certain trades must be reported to regulators for transparency.

This decentralized nature contrasts with exchanges, where orders match anonymously. In OTC forex, for instance, banks trade currencies via interbank networks, handling over $7.5 trillion daily. Technology like algorithmic trading is increasingly automating OTC processes, reducing spreads and enhancing liquidity—a emerging trend not widely covered.

OTCQX | Definition, Structure, Benefits, & Risks, & Process

Types of Securities Traded in the OTC Market

The OTC market supports a diverse array of securities, extending beyond stocks to include:

- OTC Stocks: Shares of small or foreign companies, often called microcaps or penny stocks.

- OTC Bonds: Corporate, municipal, and government bonds traded off-exchange for customization.

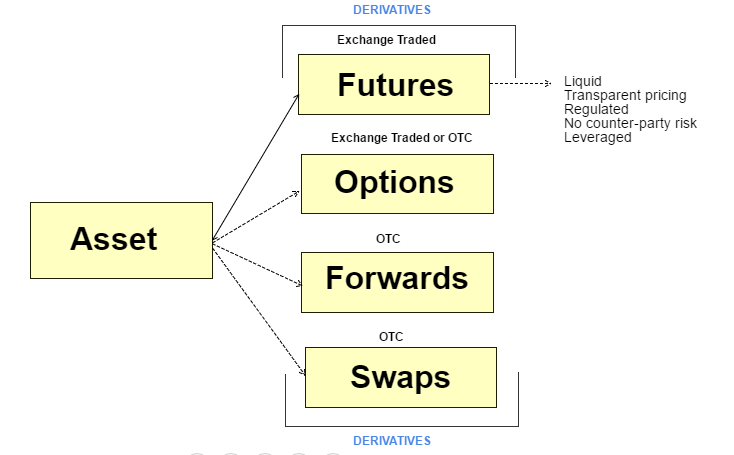

- OTC Derivatives: Non-standardized contracts like interest rate swaps, credit default swaps, forwards, and options.

- OTC Forex: Currency pairs traded 24/7 through dealer networks.

- OTC Commodities and Cryptocurrencies: Customized futures or spot trades in assets like oil or Bitcoin.

Unlike exchange-traded derivatives, OTC derivatives allow tailoring to specific needs, but they carry higher counterparty risk. This variety makes the OTC market a hub for hedging and speculation.

Futures vs. Derivatives: 5 Key Differences Explained

OTC Market Tiers: Understanding OTCQX, OTCQB, Pink Sheets, and More

The OTC Markets Group organizes U.S. OTC stocks into tiers based on disclosure and quality:

- OTCQX (Best Market): Highest standards, requires audited financials, no penny stocks; ideal for established companies.

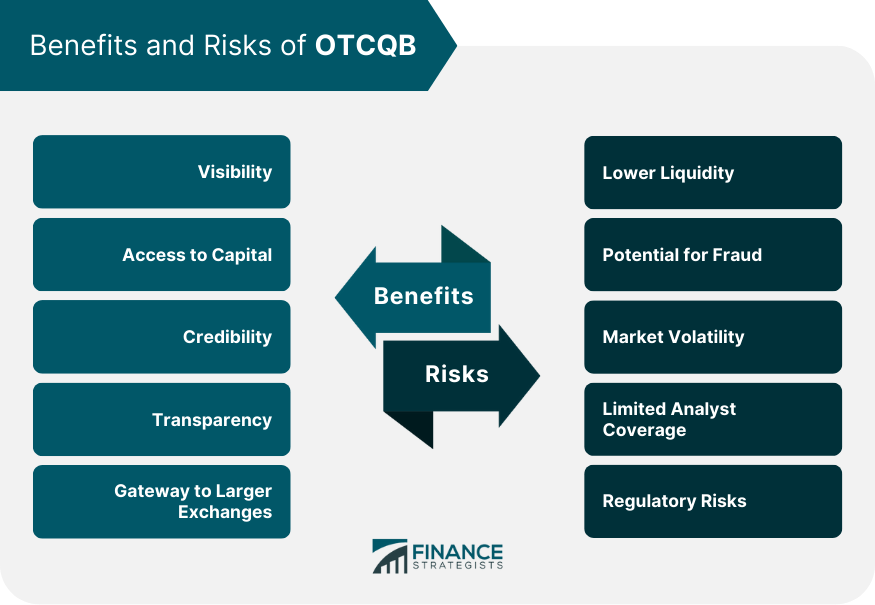

- OTCQB (Venture Market): For early-stage firms, mandates $0.01 minimum bid and GAAP compliance.

- Pink Sheets (Open Market): Minimal requirements, high risk; includes current, limited, and no-info sub-tiers.

- Grey Market/Expert Market: For non-compliant securities, restricted to professionals.

| Tier | Requirements | Risks | Examples |

| OTCQX | Audited financials, governance standards | Low | Foreign ADRs, mature firms |

| OTCQB | Minimum bid price, quarterly reports | Medium | Developing companies |

| Pink Sheets | Variable disclosure | High | Penny stocks, shell companies |

| Grey Market | No public info | Very High | Delisted or non-reporting |

This tier system helps assess risk, with OTCQX offering exchange-like quality.

OTCQB | Overview, Requirements, Benefits, Risks, & Process

OTC Market vs Exchange-Traded Markets: Key Differences

Comparing OTC market vs exchange-traded reveals stark contrasts:

| Aspect | OTC Market | Exchange-Traded Market |

| Structure | Decentralized, broker-mediated | Centralized, automated matching |

| Transparency | Lower, prices not always public | High, real-time quotes |

| Regulation | Looser, SEC/FINRA oversight | Strict listing rules |

| Liquidity | Variable, often lower | High for listed assets |

| Customization | High for derivatives | Standardized contracts |

| Risks | Counterparty, fraud higher | Systemic but mitigated |

OTC markets excel in flexibility but lag in protection, as seen in the 2008 crisis.

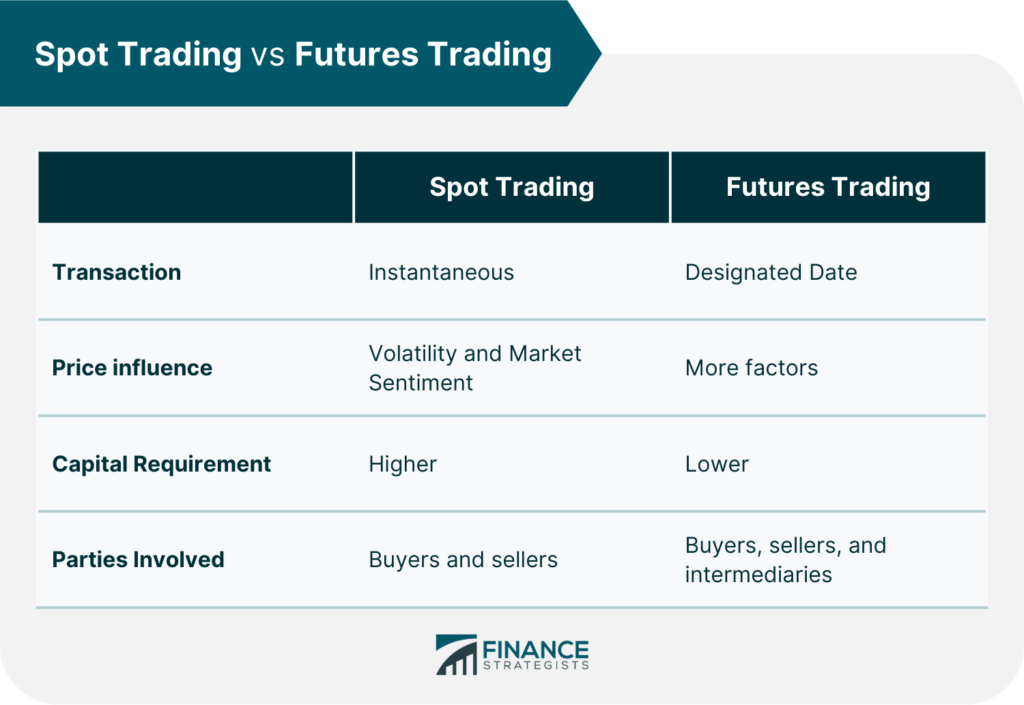

Spot Market Trading | Definition, Spot vs. Future Trading, & Pros

Advantages of the OTC Market

- Accessibility: Allows trading of unlisted securities, benefiting small issuers and investors seeking hidden gems.

- Customization: Tailored contracts in OTC derivatives for precise hedging.

- Privacy: Less public disclosure preserves anonymity.

- Cost-Effectiveness: Lower listing fees than exchanges.

- Global Reach: Facilitates international trades like ADRs.

These benefits drive OTC trading volume, especially in OTC forex and bonds.

Disadvantages and Risks of the OTC Market

- Liquidity Risks: Thin trading leads to wide bid-ask spreads.

- Counterparty Risk: Default potential without central clearing.

- Transparency Issues: “Dark market” label increases manipulation chances.

- Fraud and Volatility: Prevalent in pink sheets and penny stocks.

- Regulatory Gaps: Less oversight heightens losses.

Mitigation includes collateralization and due diligence.

Regulations Governing the OTC Market

The OTC market is regulated by the SEC, FINRA, and CFTC. Key rules:

- Rule 15c2-11: Requires current financial info for quotes (amended 2020).

- Dodd-Frank Act: Mandates clearing for certain OTC derivatives.

- FINRA Monitoring: Oversees broker-dealers and reports.

Global regs vary, with EU’s MiFID II emphasizing transparency.

How to Trade in the OTC Market: Step-by-Step Guide

- Research Securities: Use OTC Markets website for tiers and financials.

- Choose a Broker: Select firms like Schwab or Fidelity with OTC access.

- Open Account and Get Approval: For higher-risk tiers.

- Find Ticker and Place Order: Use limit orders to manage spreads.

- Monitor and Exit: Watch for volatility.

Brokers charge commissions; start small to test.

Global OTC Markets: Variations and Differences

While U.S. OTC markets dominate discussions, global versions differ:

- Europe: Under MiFID II, emphasizes multilateral trading facilities (MTFs) for transparency.

- Asia: Singapore and Hong Kong focus on OTC forex and derivatives with lighter regs.

- Emerging Markets: Higher risks but growth in OTC bonds.

Differences include trading hours, currency impacts, and regulatory harmonization via ISDA.

Emerging Trends in the OTC Market for 2026 and Beyond

In 2026, OTC market trends include:

- Digitization: AI-driven platforms reducing spreads.

- Crypto Integration: OTC crypto desks for institutional trades.

- Sustainability: ESG-focused OTC derivatives.

- Growth Stats: OTC derivatives notional up 15.9% in 2025.

- Regulatory Evolution: Push for more central clearing.

Blockchain could revolutionize settlement, addressing counterparty risk.

Case Studies: Real-World Examples in the OTC Market

- Enron Scandal (2001): Misuse of OTC derivatives led to collapse, spurring reforms.

- Tesla’s Early Days: Traded OTC before NASDAQ listing, rewarding early investors.

- Credit Default Swaps in 2008: Highlighted systemic risks, now mitigated.

These illustrate potentials and pitfalls.

Common Mistakes to Avoid in OTC Trading

- Ignoring tiers and disclosures.

- Overlooking liquidity risks in volatile assets.

- Neglecting global regs in cross-border trades.

- Failing to use stop-loss in high-volatility OTC stocks.

Tools and Platforms for OTC Market Analysis

- OTC Markets Website: For quotes and tiers.

- Bloomberg Terminal: Advanced data on OTC derivatives.

- FINRA OTC Transparency: Trade reports.

Conclusion: Mastering the OTC Market for Strategic Advantage

Grasping what is the OTC market and how it works empowers you to leverage its flexibility while managing risks. From OTC stocks and pink sheets to OTC derivatives and global variations, this decentralized arena offers unique opportunities. By combining thorough research, regulatory awareness, and emerging trends like AI and crypto, you can navigate OTC trading effectively. Whether for hedging, speculation, or diversification, the OTC market remains a vital component of modern finance.

FAQs on the OTC Market

What is the OTC market?

The OTC market is a decentralized trading platform for securities not listed on exchanges, involving direct deals via broker-dealers.

How does the OTC market work?

It operates through negotiations between parties, with market makers providing quotes on electronic networks like OTC Link.

What are the main types of OTC market tiers?

Includes OTCQX (premium), OTCQB (venture), Pink Sheets (basic), and Grey Market (restricted).

What are the risks of trading in the OTC market?

Key risks include low liquidity, counterparty risk, fraud, and volatility, especially in pink sheets.

How does the OTC market differ from stock exchanges?

OTC is decentralized with less transparency, while exchanges are centralized with strict rules and high liquidity.

Can retail investors trade in the OTC market?

Yes, through brokers, but approval may be needed for riskier securities.

What are OTC derivatives?

Customized contracts like swaps and forwards traded off-exchange for hedging.

What recent trends are shaping the OTC market in 2026?

Growth in digitization, crypto integration, and regulatory enhancements for transparency.

.