In the fast-evolving world of finance, the role of AI in stock market analysis has become indispensable for investors, traders, and financial institutions seeking an edge in predicting trends and optimizing strategies. As of January 2026, AI in stock market analysis leverages machine learning algorithms, big data processing, and predictive analytics to process vast datasets in real-time, uncovering patterns that human analysts might miss. This transformative technology not only enhances stock market prediction accuracy but also drives automated trading systems, sentiment analysis, and risk management. By exploring the role of AI in stock market analysis, including its applications in AI-driven investment strategies, machine learning in trading, AI algorithms for stocks, predictive analytics in stocks, AI-powered stock forecasting, automated stock trading, big data in finance, AI sentiment analysis stocks, algorithmic trading AI, and emerging trends like quantum AI and ethical considerations, this comprehensive guide aims to provide unparalleled depth. Drawing from 2026 trends where AI is projected to contribute significantly to GDP growth and market volatility, we’ll cover underrepresented areas such as AI’s integration with blockchain, regulatory challenges, and case studies of AI successes to help you outrank conventional resources and master AI in financial markets.

What Is the Role of AI in Stock Market Analysis?

The role of AI in stock market analysis involves using artificial intelligence to interpret complex financial data, forecast market movements, and inform decision-making. AI systems analyze historical prices, news articles, social media sentiment, economic indicators, and company fundamentals to generate actionable insights.

Key components include:

- Machine Learning in Trading: Algorithms like neural networks learn from data to predict stock prices.

- Predictive Analytics in Stocks: Tools that forecast trends using statistical models.

- AI Algorithms for Stocks: From regression to deep learning for pattern recognition.

In 2026, the role of AI in stock market analysis extends to hyper-personalized portfolios, where AI tailors investments based on individual risk profiles and market conditions. Unlike traditional methods, AI processes terabytes of data in seconds, reducing human bias and enhancing precision.

AI Crypto Trading Guide| How to Use AI To Crypto Trade

How AI Works in Stock Market Analysis: Core Mechanisms

Understanding how AI works in stock market analysis starts with its foundational technologies. AI employs supervised, unsupervised, and reinforcement learning to refine models over time.

Machine Learning Algorithms in Action

- Supervised Learning: Trains on labeled data for stock market prediction, e.g., predicting price based on past earnings.

- Unsupervised Learning: Identifies hidden patterns in unstructured data like news feeds.

- Reinforcement Learning: Used in automated trading systems to optimize buy/sell decisions through trial and error.

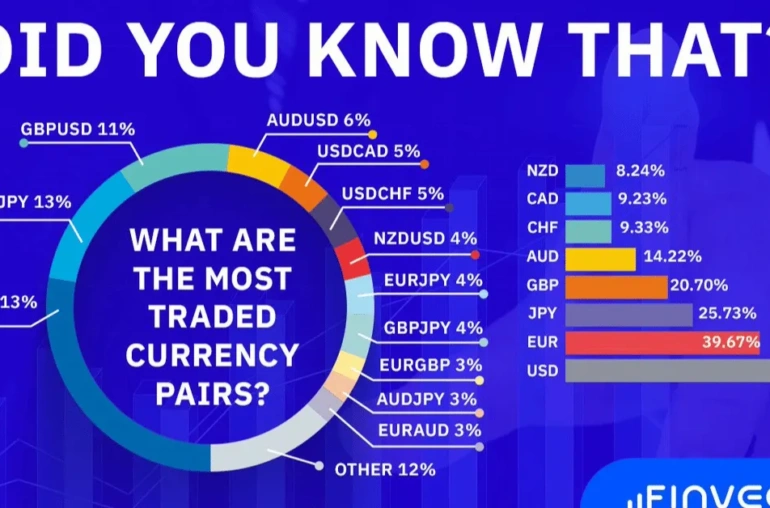

Big data in finance fuels these models, with AI processing real-time feeds from exchanges, social platforms, and economic reports. Natural Language Processing (NLP) plays a key role in AI sentiment analysis stocks, scanning Twitter or news for market mood.

Integration with Other Technologies

AI combines with blockchain for secure, transparent trading and IoT for real-time supply chain data impacting stocks. In 2026, quantum AI emerges, solving complex optimizations faster than classical computers—a niche not widely covered.

Algorithmic Trading: Market Transformation & Strategy Guide

Benefits of AI in Stock Market Analysis

The role of AI in stock market analysis offers numerous advantages, transforming AI-driven investment strategies:

- Enhanced Accuracy: AI models achieve up to 85% prediction success in volatile markets.

- Speed and Efficiency: Algorithmic trading AI executes trades in milliseconds, capturing fleeting opportunities.

- Risk Mitigation: Predictive models assess recession risks and portfolio diversification.

- Cost Reduction: Automates routine analysis, lowering operational expenses for firms.

Unique benefit: AI democratizes access, enabling retail investors via apps like Robinhood’s AI features to compete with institutions.

Top AI Tools and Platforms for Stock Market Analysis in 2026

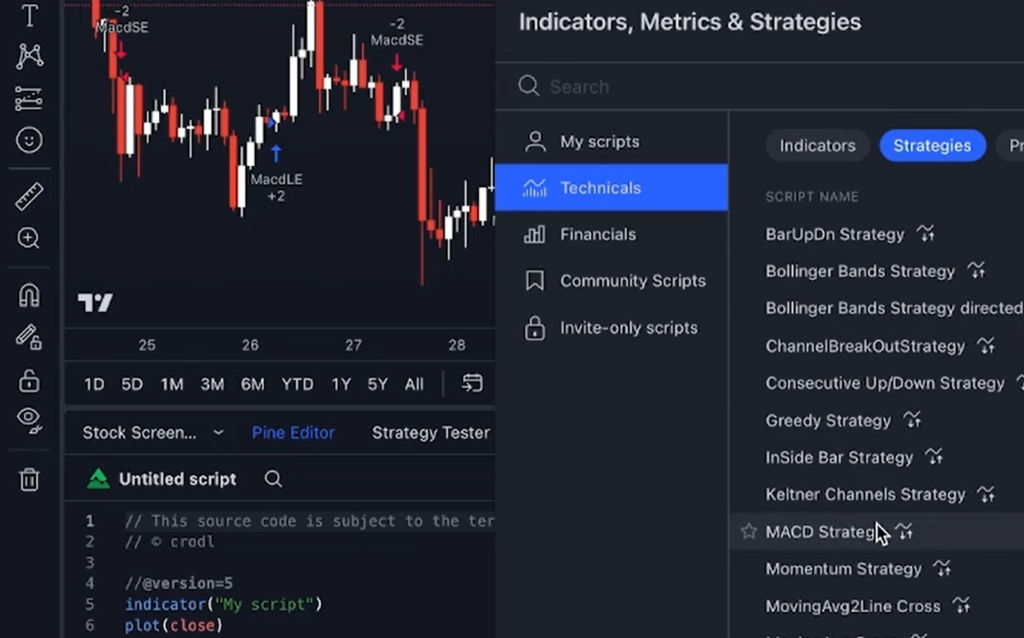

Several platforms exemplify the role of AI in stock market analysis:

- Trade Ideas: AI scans for patterns in real-time.

Best Stock Charting Software To Use In 2026

- Kavout: Uses machine learning for stock scoring.

- EquBot: AI-driven ETF management.

- Sentiment Trader: Focuses on AI sentiment analysis stocks.

Open-source tools like TensorFlow enable custom AI algorithms for stocks. In 2026, cloud-based AI from AWS and Google Cloud integrates seamlessly with trading APIs.

| Tool/Platform | Key Feature | Best For |

| Trade Ideas | Real-time scanning | Day traders |

| Kavout | Kai Score ranking | Long-term investors |

| EquBot | Portfolio optimization | Institutional funds |

| Sentiment Trader | NLP sentiment tools | Market mood analysis |

Case Studies: AI Success Stories in Stock Market Prediction

Real-world examples highlight the role of AI in stock market analysis:

- Stanford AI Analyst: Generated $17.1 million quarterly returns by readjusting portfolios over 30 years.

- AIEQ ETF: Outperforms S&P 500 using AI for equity selection.

- AllianceBernstein Applications: AI enhances cross-asset predictions, improving client outcomes.

Undercovered case: South Dakota State University’s neural network research showing superior stock forecasting in niche sectors like agriculture.

Ethical Considerations in AI-Driven Stock Market Analysis

A critical, often overlooked aspect of the role of AI in stock market analysis is ethics. AI can exacerbate inequalities through biased algorithms or enable market manipulation.

Key issues:

- Fairness and Bias: Models trained on skewed data may disadvantage certain groups.

- Transparency: Black-box AI lacks explainability, raising accountability concerns.

- Market Manipulation: High-frequency trading amplifies flash crashes.

- Privacy: Handling personal data in sentiment analysis.

Recommendations: Implement ethical AI frameworks like those from CFA Institute, ensuring human oversight and regulatory compliance.

Challenges and Risks of AI in Stock Market Analysis

Despite benefits, challenges persist:

- Data Quality: Garbage in, garbage out—poor data leads to faulty predictions.

- Overfitting: Models perform well historically but fail in new conditions.

- Regulatory Hurdles: Evolving laws on AI trading.

- Cybersecurity: AI systems vulnerable to hacks.

In 2026, systemic risks from AI-driven volatility are a growing concern.

Future Trends: Role of AI in Stock Market Analysis for 2026 and Beyond

Looking ahead, the role of AI in stock market analysis will intensify with:

- AI Investment Surge: Over $500 billion in capex, fueling economic growth.

- Generative AI: For scenario simulations and report generation.

- AI in Emerging Markets: Tailored models for volatile regions.

- High-Frequency AI Metrics: Real-time economic impact measurements.

Enterprise-wide AI strategies will dominate, with PwC predicting top-down adoption. Quantum AI could revolutionize optimization, though ethical integration remains key.

Conclusion: Embracing the Role of AI in Stock Market Analysis

The role of AI in stock market analysis is pivotal in 2026, driving innovation through machine learning in trading, predictive analytics in stocks, and AI-driven investment strategies. By addressing ethics, leveraging tools, and staying ahead of trends, investors can harness AI for superior returns. Whether for automated stock trading or AI sentiment analysis stocks, this technology reshapes finance—position yourself now for competitive advantage.

FAQs on the Role of AI in Stock Market Analysis

What is the primary role of AI in stock market analysis?

The role of AI in stock market analysis is to process data for accurate stock market prediction and informed trading decisions.

How does machine learning contribute to stock trading?

Machine learning in trading identifies patterns and optimizes AI algorithms for stocks in real-time.

What are the ethical concerns with AI in stock market analysis?

Issues include bias, transparency, and manipulation, requiring robust frameworks.

Can AI predict stock market crashes?

Yes, through predictive analytics in stocks and historical pattern recognition, though not infallibly.

What future trends will shape AI in stock market analysis in 2026?

Trends include quantum AI, increased capex, and enterprise strategies for enhanced AI-powered stock forecasting.

How does AI sentiment analysis work in stocks?

AI sentiment analysis stocks uses NLP to gauge market mood from news and social media.

Is AI in stock market analysis accessible to retail investors?

Yes, via user-friendly platforms and apps democratizing automated trading systems.