Explore the economic risks of rapid AI adoption in 2026. Understand the impact on jobs, inequality, business, and global markets, and discover strategies to mitigate AI-driven economic challenges.

Introduction: Understanding the Economic Risks of Rapid AI Adoption

Artificial intelligence (AI) is transforming the global economy at unprecedented speed. While AI adoption brings productivity gains, automation efficiencies, and innovation opportunities, rapid AI adoption poses significant economic risks.

From workforce displacement and wage inequality to market volatility and regulatory challenges, the economic risks of rapid AI adoption affect governments, businesses, and individuals alike.

This guide provides a deep, actionable analysis of AI’s economic risks, including underexplored challenges, supporting insights from global research, and strategic recommendations for policymakers, enterprises, and investors in 2026.

Supporting Keywords: AI economic impact, AI job disruption, AI inequality, AI financial risks

1. Workforce Displacement and Job Market Volatility

One of the most immediate economic risks of rapid AI adoption is workforce disruption. Automation technologies, machine learning, and AI-driven decision systems are replacing repetitive, low-skill, and even some high-skill tasks.

- Job displacement: Roles in manufacturing, logistics, customer service, and even finance are at risk as AI systems outperform human labor in speed and accuracy.

- Skill gaps: The workforce may struggle to adapt to AI-driven environments without reskilling or upskilling initiatives.

- Wage stagnation: High-skill AI specialists may see wage growth, while average workers face stagnant wages or reduced employment opportunities.

- Regional inequality: Economies heavily reliant on routine work or lacking technology infrastructure are more vulnerable to economic shocks.

Studies indicate that up to 25% of current jobs in industrialized countries could be automated within the next decade, underscoring the urgent need to prepare the workforce.

Supporting Keywords: AI job automation, AI workforce displacement, AI employment risk, AI skill gap

2. Income Inequality and Economic Polarization

Rapid AI adoption can exacerbate income inequality, creating economic polarization across industries and regions:

- High-income concentration: AI benefits often accrue to technology companies, investors, and AI professionals.

- Small business challenges: SMEs lacking AI access face competitive disadvantages, threatening revenue and growth.

- Global disparities: Emerging economies without AI infrastructure risk falling further behind industrialized nations.

Without equitable AI strategies, automation-driven productivity gains may disproportionately favor a small economic elite, increasing social unrest and economic instability.

Supporting Keywords: AI economic inequality, AI wealth gap, AI economic polarization, AI SME impact

3. Disruption of Traditional Business Models

Rapid AI adoption transforms business models at unprecedented speeds, creating economic uncertainty and market disruption:

- Industry disruption: Sectors like retail, finance, healthcare, and transportation are experiencing AI-driven competitive shifts.

- Market volatility: Traditional businesses unable to adopt AI quickly risk declining revenue or bankruptcy.

- SME vulnerability: Small businesses struggle to compete with AI-enabled enterprises that optimize costs, marketing, and operations.

- Consumer behavior changes: AI personalization and dynamic pricing reshape demand patterns, affecting long-standing revenue streams.

Businesses must adapt to AI integration carefully to mitigate sudden market shocks and maintain operational continuity.

Supporting Keywords: AI business disruption, AI market volatility, AI SME risk, AI industry transformation

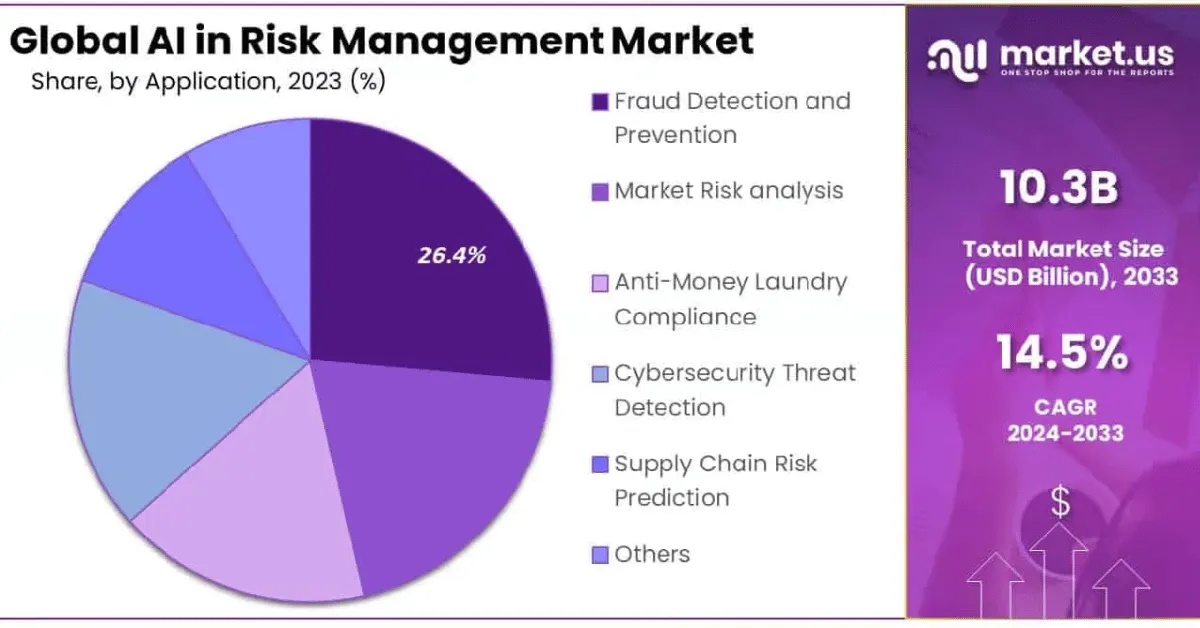

4. AI-Induced Financial and Market Risks

The economic risks of rapid AI adoption extend to financial systems and capital markets:

- Algorithmic trading risks: AI-driven trading algorithms can trigger flash crashes and extreme volatility.

- Credit and investment risk: Rapid AI adoption in financial services can generate systemic risk if mismanaged.

- Banking automation: AI in lending, fraud detection, and risk assessment may introduce biases that amplify financial instability.

- Asset misallocation: Rapid AI-driven decisions may prioritize short-term gains, neglecting long-term economic sustainability.

Experts warn that unregulated AI deployment in financial markets could amplify global economic shocks.

Supporting Keywords: AI financial risk, AI market instability, AI algorithmic trading, AI investment risk

5. Regulatory and Policy Challenges

Governments face unprecedented challenges in regulating AI adoption, which introduces economic risks if not managed properly:

- Lack of AI governance: Rapid deployment outpaces regulatory frameworks, creating gaps in accountability and transparency.

- Data privacy and economic compliance: Businesses adopting AI rapidly may violate laws, leading to fines and market penalties.

- Taxation and labor policies: Traditional tax systems struggle to capture AI-driven economic value, impacting public revenue.

- Global coordination: Uneven regulation across countries increases the risk of economic imbalances and AI-driven trade tensions.

Supporting Keywords: AI regulation, AI policy risk, AI governance challenges, AI economic oversight

6. Unintended Consequences and Long-Term Economic Risks

Rapid AI adoption may produce unexpected economic consequences:

- Technological monopolies: Large AI corporations can dominate markets, restricting competition and innovation.

- Dependency risks: Economies reliant on AI may experience systemic fragility if AI systems fail.

- Skill obsolescence: Continuous AI advancement risks rendering human skills obsolete faster than reskilling programs can compensate.

- Social costs: Unemployment, inequality, and economic polarization may generate long-term societal costs.

These risks underscore the importance of balanced, phased AI adoption strategies with economic safeguards.

Supporting Keywords: AI long-term risk, AI economic dependency, AI monopolies, AI societal impact

7. Mitigation Strategies for the Economic Risks of Rapid AI Adoption

Despite the risks, strategic interventions can reduce negative economic impacts:

- Reskilling and upskilling programs: Governments and enterprises should invest in training to prepare workers for AI-enhanced roles.

- AI adoption policies for SMEs: Support programs to provide small businesses with AI tools and expertise.

- Ethical AI governance: Implement transparency, accountability, and explainable AI practices.

- Economic diversification: Reduce dependency on AI-heavy industries to minimize systemic shocks.

- Global collaboration: Harmonize AI regulations to prevent economic imbalances and trade disputes.

- AI taxation and revenue frameworks: Capture AI-driven productivity gains to fund social programs.

- Monitoring and evaluation: Continuously assess AI’s economic impact to adjust policies proactively.

These mitigation strategies ensure AI adoption drives growth without creating disproportionate economic risks.

Supporting Keywords: AI risk mitigation, AI economic strategy, AI workforce development, AI ethical governance

8. Case Studies: Lessons from Rapid AI Adoption

- Manufacturing in Developed Economies: Automation improved productivity but displaced routine labor, requiring large-scale retraining programs.

- Financial Markets: Algorithmic AI trading produced flash crashes, emphasizing the need for regulatory oversight.

- Retail and E-Commerce SMEs: Rapid AI adoption by large players disrupted traditional SMEs, highlighting the importance of accessible AI solutions.

- Healthcare: AI diagnosis tools increased efficiency but created ethical and economic implications for reimbursement systems.

Supporting Keywords: AI adoption case study, AI economic lessons, AI SME disruption, AI market impact

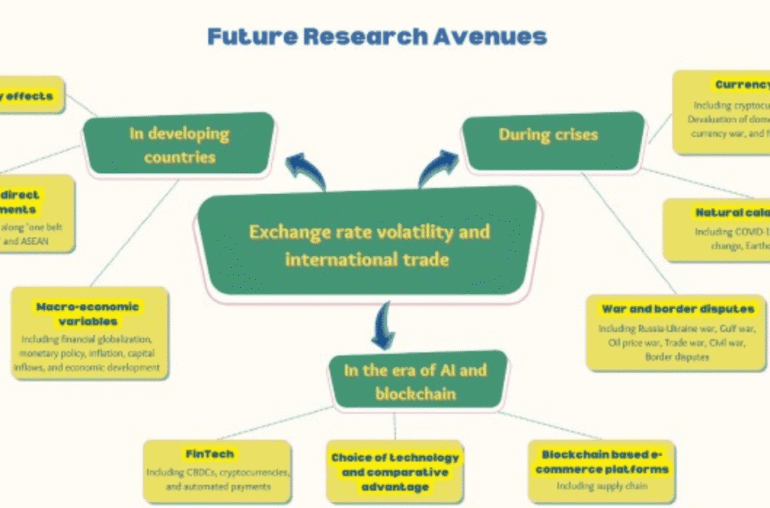

9. Future Outlook: Balancing Growth and Economic Stability

By 2030, AI adoption is expected to contribute trillions in global GDP, but unchecked rapid adoption risks long-term economic instability. Key predictions include:

- Shifts in employment toward AI-enhanced roles

- Increased wealth concentration without inclusive AI policies

- Regulatory frameworks evolving slowly relative to AI growth

- Global disparities widening if developing nations lag in AI adoption

Balanced, strategic AI adoption—with investment in workforce, SMEs, and governance—will be essential to harness economic growth while mitigating systemic risks.

Supporting Keywords: AI economic outlook, AI 2030 predictions, AI workforce evolution, AI global economy

Conclusion

The economic risks of rapid AI adoption are complex and multifaceted. While AI promises unprecedented productivity, innovation, and efficiency, hasty implementation without careful planning can lead to:

- Workforce disruption and job loss

- Widening income inequality

- Market volatility and business disruption

- Regulatory and compliance challenges

- Long-term systemic economic fragility.