The future of financial services with AI is not a distant concept. It is already unfolding across banking, payments, lending, insurance, wealth management, and fintech. Artificial intelligence is changing how financial institutions operate, how customers interact with money, and how risk is measured and managed.

AI is transforming financial services by increasing efficiency, improving decision-making, reducing costs, and enabling personalization at scale. At the same time, it introduces new challenges related to trust, regulation, employment, and systemic risk.

This article provides a deep, practical analysis of the future of financial services with AI, focusing on real use cases, structural changes, and what most discussions fail to explain.

Why AI Is Central to the Future of Financial Services

Financial services are data-intensive, rule-based, and time-sensitive. These characteristics make them ideal for AI adoption.

AI excels at:

- Processing massive datasets

- Identifying patterns and anomalies

- Automating repetitive decisions

- Predicting outcomes under uncertainty

This alignment explains why the future of financial services with AI is accelerating faster than in most other industries.

What the Future of Financial Services with AI Really Means

AI in financial services is not just about chatbots or automation. It represents a structural shift in how financial systems operate.

The future includes:

- Predictive finance instead of reactive finance

- Personalized financial products at scale

- Real-time risk and fraud detection

- Autonomous financial decision systems

- Lower dependence on manual processes

This transformation affects institutions, customers, regulators, and workers alike.

How AI Is Transforming Core Financial Services

To understand the future of financial services with AI, we need to examine each major segment.

1. AI in Banking and Digital Banking

Traditional banking is being redefined.

AI enables banks to:

- Automate customer onboarding

- Improve credit assessment

- Detect fraud in real time

- Personalize financial recommendations

Major institutions such as JPMorgan Chase already use AI across compliance, risk, and customer analytics, signaling where the industry is heading.

2. AI in Payments and Transaction Processing

Payments are becoming faster, smarter, and safer.

AI improves payment systems by:

- Detecting fraudulent transactions instantly

- Reducing false positives

- Optimizing transaction routing

- Supporting real-time settlement

This leads to lower costs and better user experiences, a key pillar of the future of financial services with AI.

3. AI in Lending and Credit Scoring

AI is reshaping how creditworthiness is assessed.

Instead of relying only on traditional credit scores, AI evaluates:

- Transaction behavior

- Cash flow patterns

- Alternative financial data

- Real-time risk indicators

This expands access to credit while improving default prediction accuracy.

4. AI in Wealth Management and Investing

Wealth management is moving from advisor-centric to AI-assisted.

AI enables:

- Robo-advisors

- Automated portfolio rebalancing

- Risk profiling based on behavior

- Personalized investment strategies

Asset managers such as BlackRock increasingly rely on AI-driven analytics to manage complex portfolios at scale.

5. AI in Risk Management and Compliance

Risk management is one of the strongest AI use cases.

AI helps financial institutions:

- Predict credit and market risk

- Monitor systemic risk

- Detect regulatory breaches

- Automate compliance reporting

RegTech solutions powered by AI reduce human error and regulatory costs.

6. AI in Fraud Detection and Financial Security

Fraud detection is becoming autonomous.

AI systems analyze:

- Transaction patterns

- User behavior

- Network anomalies

This reduces fraud losses and strengthens trust, a critical requirement for the future of financial services with AI.

7. AI in Insurance and Underwriting

Insurance is also being transformed.

AI improves:

- Risk assessment

- Claims processing

- Fraud detection

- Dynamic pricing

Policies become more accurate, faster to issue, and fairer.

8. AI and the Rise of Fintech Innovation

Fintech companies are AI-native by design.

AI enables fintechs to:

- Launch faster

- Operate with smaller teams

- Compete with large banks

- Offer niche, personalized products

This intensifies competition across the financial ecosystem.

9. AI and Customer Experience in Financial Services

Customer expectations are changing.

AI enables:

- 24/7 virtual assistants

- Personalized financial insights

- Predictive customer support

- Seamless omnichannel experiences

The future of financial services with AI is customer-centric, not institution-centric.

Economic Impact of AI on Financial Services

AI affects financial services at a macro level.

Expected outcomes include:

- Lower operational costs

- Increased productivity

- Higher financial inclusion

- Faster innovation cycles

At the same time, AI may increase market concentration if access to data and compute remains uneven.

Workforce Impact: Jobs and Skills in Financial Services

AI will not eliminate financial jobs, but it will transform them.

Roles most affected:

- Back-office operations

- Manual compliance tasks

- Basic customer support

Roles in demand:

- Data and AI specialists

- Risk analysts

- AI governance professionals

Reskilling is central to a positive future of financial services with AI.

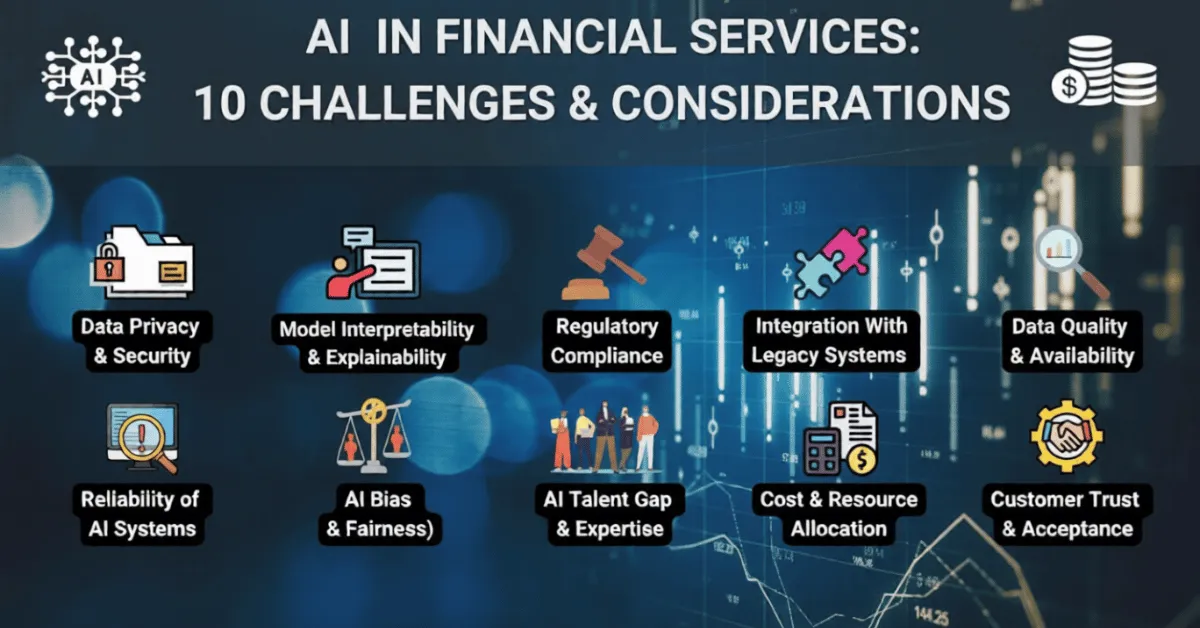

Risks and Challenges of AI in Financial Services

No serious analysis ignores the risks.

Key Challenges

- Data privacy and security

- Algorithmic bias

- Lack of transparency

- Over-reliance on automation

- Regulatory uncertainty

Institutions such as the Bank for International Settlements stress the need for robust AI governance frameworks.

Regulation and Trust in the AI-Driven Financial Future

Trust will determine adoption speed.

Regulators focus on:

- Explainable AI

- Fair lending standards

- Accountability for AI decisions

- Data protection

The future of financial services with AI depends on balancing innovation with stability.

AI, Financial Stability, and Systemic Risk

At scale, AI can amplify both efficiency and risk.

Potential systemic concerns include:

- Herd behavior driven by similar models

- Flash crashes

- Over-optimized strategies

Human oversight remains essential.

Timeline: What the Future Looks Like

- Short term (1–3 years): Automation, fraud detection, personalization

- Medium term (3–7 years): Predictive finance, AI-driven risk systems

- Long term (7–15 years): Autonomous financial infrastructure

The future of financial services with AI is evolutionary, not instant.

What Most Articles Get Wrong

Most content fails because it:

- Focuses only on technology

- Ignores regulation and trust

- Assumes AI replaces humans

- Avoids discussing limits

Real transformation is institutional, not just technical.

Frequently Asked Questions

How will AI change financial services?

AI will make financial services faster, smarter, more personalized, and more efficient.

Will AI replace banks?

No. It will reshape how banks operate and compete.

Is AI in finance risky?

It carries risks, but proper governance significantly reduces them.

Final Conclusion

So, what is the future of financial services with AI?

It is a future where financial decisions become predictive, operations become autonomous, and services become deeply personalized. AI will lower costs, expand access, and redefine competition, while regulation and governance will shape its limits.

Financial services are no longer just about capital.

They are about intelligence, trust, and data.

The institutions that master AI responsibly will define the next era of global finance.