Economic forecasting has always been difficult. Economies are complex, adaptive systems influenced by millions of decisions, shocks, and feedback loops. With the rise of artificial intelligence, a critical question has emerged: can AI improve economic forecasting accuracy, or does it simply add complexity to an already uncertain task?

AI is now widely used by central banks, financial institutions, and research organizations to analyze economic data. However, AI does not replace uncertainty. It changes how forecasts are produced, what signals are captured, and where errors come from.

This article answers can AI improve economic forecasting accuracy by explaining how AI-based forecasting works, where it performs better than traditional models, where it fails, and why the most accurate forecasts today rely on hybrid systems.

What Is Economic Forecasting?

Economic forecasting is the process of predicting future economic conditions using data, models, and assumptions.

Common forecast targets include:

- GDP growth

- Inflation

- Employment and unemployment

- Interest rates

- Consumer spending

- Business investment

Traditional forecasting relies on statistical and structural economic models. The question can AI improve economic forecasting accuracy depends on how AI changes these foundations.

Why Economic Forecasting Is So Difficult

Before evaluating AI, it’s important to understand the problem itself.

Economic forecasting is difficult because:

- Economies are nonlinear systems

- Human behavior changes over time

- Policy decisions alter incentives

- External shocks are unpredictable

- Data is delayed and revised

Even the best human economists struggle with accuracy, especially during turning points like recessions or inflation surges.

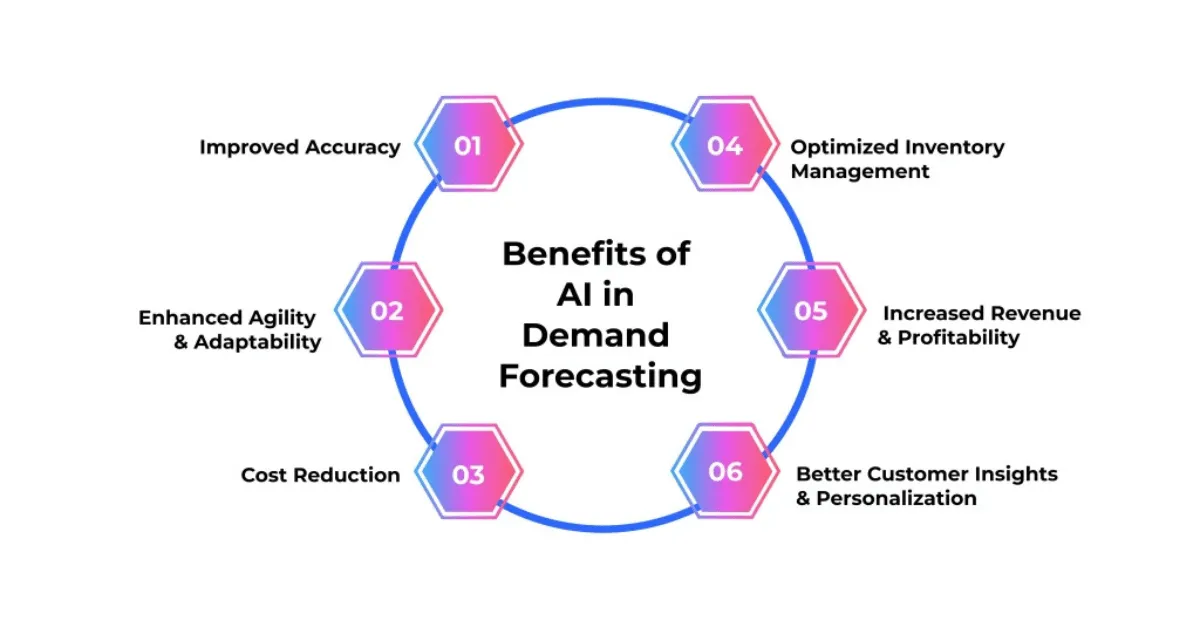

What AI Brings to Economic Forecasting

AI changes forecasting by shifting from theory-driven models to data-driven learning.

AI systems can:

- Process massive datasets

- Detect nonlinear relationships

- Learn from historical patterns

- Update forecasts continuously

- Integrate unstructured data

These capabilities are central to evaluating can AI improve economic forecasting accuracy.

How AI Improves Economic Forecasting Accuracy

Let’s break down the actual mechanisms.

1. AI Captures Nonlinear Economic Relationships

Traditional economic models often assume linear relationships.

AI models:

- Capture nonlinear interactions

- Detect hidden correlations

- Learn complex feedback loops

This improves forecasting accuracy in economies where cause-and-effect relationships are not simple or stable.

2. AI Uses More and Better Data

AI expands the data universe.

In addition to official statistics, AI can analyze:

- Financial market data

- Consumer transactions

- Satellite imagery

- Online prices

- Job postings

- News and text data

This real-time, high-frequency data improves short-term forecasting accuracy.

3. AI Improves Nowcasting Accuracy

Nowcasting focuses on predicting the present or near future.

AI excels at nowcasting because it:

- Integrates real-time indicators

- Reduces reliance on delayed official data

- Updates forecasts dynamically

Many central banks use AI-enhanced nowcasting to track economic momentum more accurately.

4. AI Reduces Human Bias in Forecasting

Human forecasts suffer from:

- Overconfidence

- Anchoring to past trends

- Political or institutional bias

AI applies rules consistently and updates predictions based on data, not narratives. This objectivity improves forecast reliability in many cases.

5. AI Enhances Forecast Combination and Ensemble Models

No single model is always correct.

AI improves forecasting accuracy by:

- Combining multiple models

- Weighting forecasts dynamically

- Identifying which models perform best in different conditions

This ensemble approach often outperforms individual human or statistical forecasts.

Where AI Outperforms Traditional Economic Forecasting

AI tends to outperform in:

- Short-term forecasts

- High-frequency indicators

- Stable economic environments

- Data-rich domains

For example, institutions like the International Monetary Fund use machine learning to complement traditional macroeconomic analysis, especially in short-horizon forecasting.

Where AI Struggles in Economic Forecasting

Answering can AI improve economic forecasting accuracy also requires honesty about limitations.

1. AI Struggles With Structural Breaks

AI learns from historical data.

When the economy experiences:

- Pandemics

- Wars

- Sudden policy shifts

- Financial crises

historical patterns break down. AI models often fail during these regime changes.

2. AI Cannot Predict Policy Decisions

Economic outcomes depend heavily on:

- Central bank actions

- Fiscal policy

- Regulatory changes

AI cannot reliably forecast political decisions that reshape economic trajectories.

3. AI Is Sensitive to Data Quality

Bad data leads to bad forecasts.

AI struggles when:

- Data is incomplete

- Data is revised later

- Measurement methods change

Economic data revisions can undermine model accuracy.

4. AI Models Lack Economic Interpretation

Many AI models are “black boxes.”

This creates problems:

- Hard to explain forecasts

- Difficult to justify policy decisions

- Limited trust from policymakers

Explainability matters as much as accuracy in economics.

AI vs Traditional Economic Models

Traditional Models

- Theory-driven

- Interpretable

- Weak with nonlinear data

- Slow to adapt

AI Models

- Data-driven

- Adaptive

- Strong with complex patterns

- Less interpretable

This comparison shows why the real answer to can AI improve economic forecasting accuracy is not either-or.

Hybrid Models: The Real Forecasting Advantage

The most accurate forecasts today use hybrid systems.

Hybrid forecasting combines:

- Economic theory

- Human judgment

- Statistical models

- AI and machine learning

Organizations such as the Federal Reserve increasingly use AI as a complement, not a replacement, for traditional economic analysis.

AI in Inflation Forecasting

Inflation forecasting is notoriously difficult.

AI improves inflation forecasts by:

- Tracking real-time prices

- Analyzing supply chain data

- Detecting early demand pressures

However, AI still struggles with policy-driven inflation shifts.

AI in GDP and Growth Forecasting

AI improves growth forecasting by:

- Integrating high-frequency indicators

- Improving short-term accuracy

- Detecting turning points earlier

Long-term growth forecasting remains uncertain due to structural change.

AI in Labor Market Forecasting

Labor markets generate rich data.

AI improves forecasts of:

- Employment trends

- Job vacancies

- Wage pressure

This makes labor forecasting one of AI’s strongest economic applications.

Does AI Actually Improve Forecast Accuracy? What Evidence Shows

Empirical studies suggest:

- Moderate but meaningful accuracy improvements

- Strong gains in nowcasting

- Limited gains in long-term forecasts

AI improves forecasting accuracy at the margins, not miracles.

Risks of Overreliance on AI Forecasts

Overusing AI creates risks:

- False confidence

- Herd behavior across institutions

- Ignoring uncertainty

- Model-driven blind spots

Forecasts should guide decisions, not dictate them.

The Future of AI in Economic Forecasting

Looking ahead:

- AI will improve real-time monitoring

- Hybrid models will dominate

- Explainable AI will grow in importance

- Forecast uncertainty will be communicated more clearly

The goal is not perfect prediction, but better decision-making under uncertainty.

What Most Articles Get Wrong

Most content fails because it:

- Treats forecasting as prediction, not probability

- Ignores uncertainty

- Overstates AI capabilities

- Avoids discussing failures

Economic forecasting is about ranges, not point estimates.

Frequently Asked Questions

Can AI replace human economists?

No. AI supports analysis but cannot replace judgment or policy understanding.

Is AI more accurate than traditional models?

Sometimes, especially short-term. Not always.

Should governments rely on AI forecasts?

Yes, as inputs. Not as sole decision-makers.

Final Conclusion

So, can AI improve economic forecasting accuracy?

Yes, but with important caveats. AI improves short-term forecasts, captures complex patterns, reduces bias, and enhances model combinations. However, it struggles with structural breaks, policy shifts, and deep uncertainty.

The most accurate economic forecasts today are not purely human or purely AI-driven. They are hybrid systems that combine data, theory, and judgment.

AI does not eliminate uncertainty.

It helps us understand it better.

And in economics, that’s often the real win.