The question how much do undocumented workers contribute to the economy is often discussed emotionally, but the real answer lies in economic data, labor market dynamics, and fiscal impact. When economists examine undocumented workers as part of the workforce rather than a political category, a clearer picture emerges.

Undocumented workers are deeply embedded in modern economies. They produce goods, provide essential services, pay taxes, and support entire industries. This article breaks down how much undocumented workers contribute to the economy, using measurable economic mechanisms that are often ignored in mainstream discussions.

Who Are Undocumented Workers in Economic Terms?

From an economic standpoint, undocumented workers are foreign-born individuals who live and work in a country without formal legal immigration status. Despite this status, they actively participate in the economy through:

- Employment

- Consumption

- Tax payments

- Housing markets

- Business formation (directly or indirectly)

Understanding how much undocumented workers contribute to the economy starts with recognizing that economic participation does not require legal status.

How Much Do Undocumented Workers Contribute to the Economy?

Undocumented workers contribute through multiple economic channels. Their impact extends far beyond wages or employment numbers.

1. Contribution to Gross Domestic Product (GDP)

One of the most overlooked facts is that undocumented workers contribute directly to national output.

Undocumented workers:

- Produce goods and services

- Increase total economic output

- Support productivity in labor-intensive industries

Economists estimate that undocumented workers contribute hundreds of billions of dollars annually to GDP in large economies. Removing this labor force would significantly reduce economic output and disrupt supply chains.

This GDP contribution is a central answer to how much undocumented workers contribute to the economy.

2. Labor Force Participation and Workforce Supply

Undocumented workers play a critical role in maintaining labor force size.

They are heavily represented in sectors such as:

- Agriculture

- Construction

- Food processing

- Hospitality

- Healthcare support

- Logistics and warehousing

These industries depend on undocumented labor to remain operational. Without this workforce, labor shortages would increase, production would slow, and consumer prices would rise.

3. Tax Contributions by Undocumented Workers

A major misconception is that undocumented workers do not pay taxes. In reality, they contribute billions annually.

Types of Taxes Paid

Undocumented workers pay:

- Sales taxes

- Property taxes (directly or through rent)

- Payroll taxes

- Income taxes using Individual Taxpayer Identification Numbers

Agencies like the Internal Revenue Service process millions of tax filings from undocumented workers each year.

This tax contribution is a core part of how much undocumented workers contribute to the economy.

4. Social Security and Medicare Contributions

Undocumented workers contribute to social insurance programs they cannot fully access.

Through payroll deductions, undocumented workers pay into:

- Social Security

- Medicare

The Social Security Administration has reported that undocumented workers contribute billions annually to trust funds without receiving retirement benefits.

This creates a net positive fiscal effect.

5. Impact on Consumer Spending and Demand

Undocumented workers are consumers.

They spend income on:

- Housing

- Food

- Transportation

- Utilities

- Education for children

This spending stimulates local economies, supports small businesses, and generates indirect employment.

Consumer demand is an often-ignored but crucial component of how much undocumented workers contribute to the economy.

6. Industry-Level Economic Dependence

Certain industries rely disproportionately on undocumented labor.

Agriculture

Undocumented workers sustain food production and harvesting operations.

Construction

They support housing supply and infrastructure development.

Hospitality and Food Services

They keep operating costs manageable and services accessible.

Without undocumented workers, labor costs in these sectors would rise sharply, leading to higher prices for consumers.

7. Productivity and Cost Stabilization

Undocumented workers help stabilize production costs.

Their participation:

- Keeps businesses competitive

- Prevents outsourcing of domestic production

- Reduces inflationary pressure

By maintaining productivity, undocumented labor indirectly benefits the broader economy.

8. Entrepreneurship and Small Business Activity

Although less discussed, undocumented workers also contribute through entrepreneurship.

They:

- Start informal and formal businesses

- Create jobs for other workers

- Serve niche markets

Immigrant-driven entrepreneurship is a recognized driver of local economic growth, noted by institutions like the World Bank.

9. Fiscal Impact: Taxes vs Public Services

A key part of how much undocumented workers contribute to the economy is fiscal balance.

Most economic studies show:

- Undocumented workers contribute more in taxes than they consume in public services at the federal level

- They are largely excluded from welfare programs

- Emergency and education costs exist but are often offset by tax revenue

This results in a net neutral or positive fiscal impact over time.

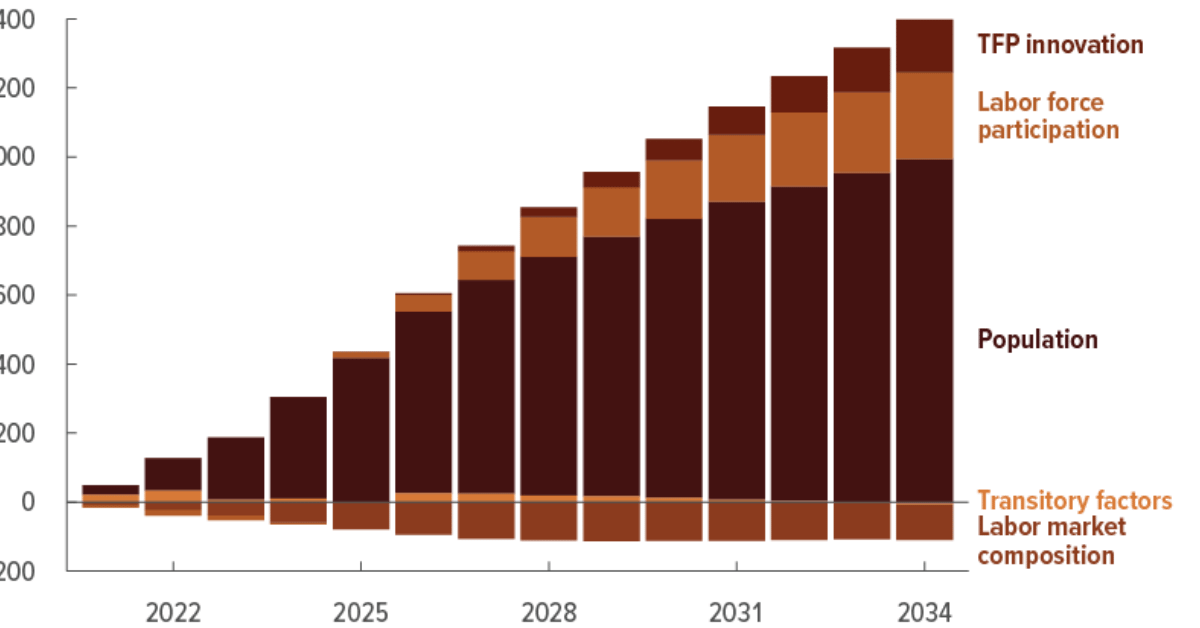

10. Long-Term Economic Contribution

Undocumented workers contribute to long-term growth by:

- Supporting demographic balance

- Increasing labor supply in aging economies

- Contributing to future generations through citizen children

Children of undocumented workers often become skilled contributors to the formal economy.

What Happens If Undocumented Workers Are Removed?

Economists widely agree that removing undocumented workers would:

- Shrink GDP

- Increase labor shortages

- Raise consumer prices

- Disrupt food and housing supply chains

This counterfactual analysis reinforces how much undocumented workers contribute to the economy.

Why This Contribution Is Often Underestimated

Their contribution is underestimated because:

- Much work is informal or undercounted

- Productivity gains are indirect

- Political narratives overshadow economic data

Yet the economic footprint is real and measurable.

Frequently Asked Questions

Do undocumented workers pay taxes?

Yes. They pay sales, payroll, property, and income taxes.

Do undocumented workers receive government benefits?

Most federal benefits are unavailable to undocumented workers.

Are undocumented workers a net economic benefit?

Most economic research shows they provide a net positive contribution over time.

Final Conclusion

So, how much do undocumented workers contribute to the economy?

They contribute billions in GDP, stabilize critical industries, pay substantial taxes, support social insurance systems, and fuel consumer demand. Their economic role is structural, not marginal.

When analyzed through economics rather than politics, undocumented workers are not a drain on the economy. They are an essential part of it.