The foreign exchange market is the largest financial market in the world, with trillions of dollars traded every day. Yet despite thousands of possible currency combinations, only a small group dominates global trading volume. Understanding the most traded currency pairs in forex is essential for beginners and experienced traders alike.

These currency pairs offer the highest liquidity, tightest spreads, and most predictable price behavior. This article explains the most traded currency pairs in forex, why they dominate the market, how they behave, and which ones are best for different trading styles.

What Are Currency Pairs in Forex?

In forex trading, currencies are always traded in pairs. One currency is exchanged for another.

Each pair consists of:

- Base currency (first currency)

- Quote currency (second currency)

Price movements reflect changes in the value of one currency relative to the other. The most traded currency pairs in forex attract the highest trading volume because of global economic demand and institutional participation.

Why Some Currency Pairs Are Traded More Than Others

Not all currency pairs are equal.

The most traded currency pairs in forex share these characteristics:

- High liquidity

- Strong global economies

- Heavy institutional involvement

- Low transaction costs

- Predictable behavior

Currencies tied to major economies naturally dominate forex trading volume.

Categories of Currency Pairs in Forex

Before listing them, it’s important to understand classification.

Major Currency Pairs

- Include the US dollar

- Highest liquidity

- Tightest spreads

Minor Currency Pairs

- Do not include the US dollar

- Moderate liquidity

Exotic Currency Pairs

- Include emerging market currencies

- High volatility

- Wide spreads

The most traded currency pairs in forex come almost entirely from the major category.

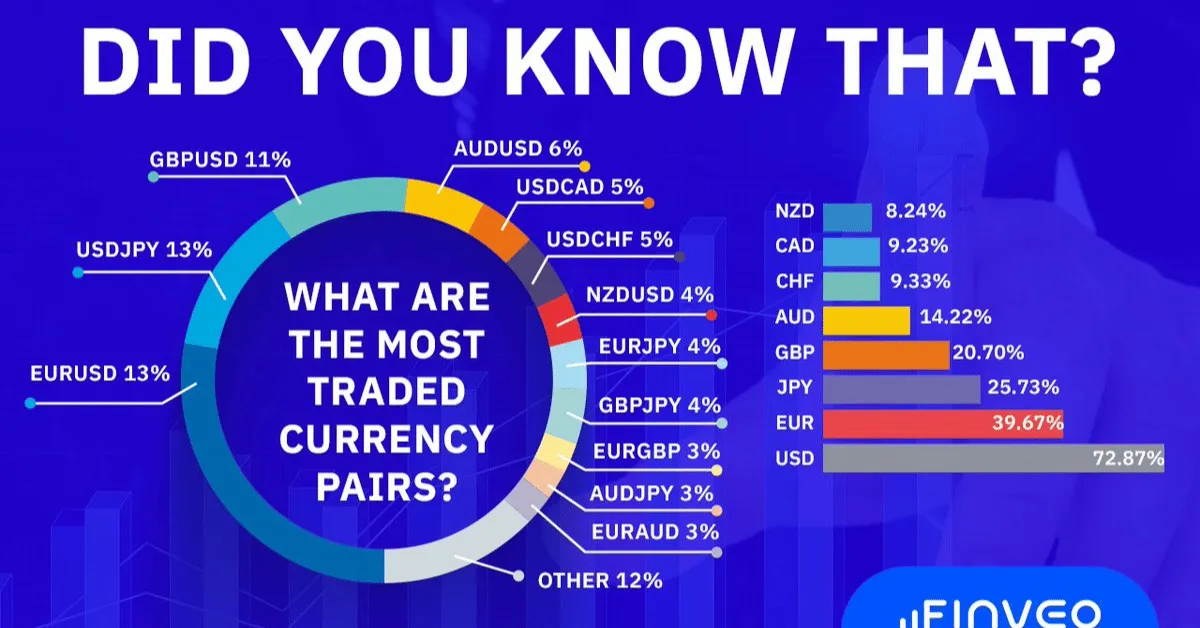

Most Traded Currency Pairs in Forex (Ranked)

Below are the most traded currency pairs in forex, ranked by global trading volume and market importance.

1. EUR/USD – The Most Traded Currency Pair in Forex

EUR/USD is the single most traded currency pair in the world.

Why It Dominates

- Represents the Eurozone and the United States

- Massive liquidity

- Extremely tight spreads

- Strong institutional participation

Key Characteristics

- Smooth price movement

- Highly technical

- Responds well to economic data

EUR/USD alone accounts for a significant share of total forex market volume.

2. USD/JPY – The Second Most Traded Currency Pair

USD/JPY is another pillar of the most traded currency pairs in forex.

Why Traders Love It

- High liquidity

- Influenced by interest rates

- Strong correlation with global risk sentiment

Key Characteristics

- Clean trends

- Active during Asian and US sessions

- Sensitive to central bank policy

3. GBP/USD – High Volatility, High Volume

Often called “Cable,” GBP/USD is one of the most actively traded pairs.

Why It’s Popular

- Strong UK and US economies

- High trading volume

- Excellent volatility for day traders

Key Characteristics

- Faster price movements

- Larger daily ranges

- Strong reaction to news

This pair rewards disciplined traders but can punish careless ones.

4. USD/CHF – The Safe-Haven Pair

USD/CHF represents the US dollar against the Swiss franc.

Why It’s Traded Heavily

- Swiss franc is a safe-haven currency

- Used for risk-off trading

- Stable liquidity

Key Characteristics

- Lower volatility

- Strong correlation with EUR/USD

- Sensitive to global uncertainty

USD/CHF remains one of the most traded currency pairs in forex due to its stability.

5. AUD/USD – Commodity-Driven Favorite

AUD/USD is popular among swing and position traders.

Why It’s Widely Traded

- Australia’s commodity-based economy

- Strong link to global growth

- Active during Asian sessions

Key Characteristics

- Trend-friendly

- Influenced by commodity prices

- Responds to Chinese economic data

6. USD/CAD – Oil-Driven Currency Pair

USD/CAD is heavily influenced by energy markets.

Why It’s Important

- Canada is a major oil exporter

- Strong correlation with crude oil prices

- High institutional interest

Key Characteristics

- Predictable reactions to oil

- Moderate volatility

- Clean technical structure

7. NZD/USD – Smaller but Still Highly Traded

NZD/USD completes the list of major pairs.

Why Traders Use It

- Similar behavior to AUD/USD

- Commodity exposure

- Good liquidity

Key Characteristics

- More volatile than AUD/USD

- Clear trends

- Strong reaction to interest rate changes

Why the US Dollar Dominates the Most Traded Currency Pairs in Forex

The US dollar appears in nearly all of the most traded currency pairs in forex.

Reasons include:

- Global reserve currency status

- Used in international trade

- Central role in global finance

- High trust and liquidity

This dominance shapes the entire forex market.

Trading Characteristics of the Most Traded Currency Pairs in Forex

These pairs share important traits.

Tight Spreads

Lower costs make them ideal for beginners and active traders.

High Liquidity

Large orders can be executed without price slippage.

Reliable Technical Behavior

Support and resistance levels are respected more consistently.

Best Currency Pairs for Beginners

Beginners should focus on the most traded currency pairs in forex because they:

- Are easier to analyze

- Have lower transaction costs

- Are less prone to manipulation

Best Beginner Pairs

- EUR/USD

- USD/JPY

- GBP/USD

Avoid exotic pairs early on.

Best Trading Sessions for Major Currency Pairs

Timing matters.

London Session

- High volatility

- Strong trends

New York Session

- Heavy volume

- Major news releases

London–New York Overlap

- Best trading conditions

- Maximum liquidity

Most trading volume in the most traded currency pairs in forex occurs during these sessions.

Institutional Trading and Currency Pair Volume

Banks, hedge funds, and corporations focus almost exclusively on major pairs.

They prefer:

- Predictability

- Liquidity

- Low execution cost

Retail traders benefit by trading where institutions trade.

Common Mistakes When Trading Popular Currency Pairs

Even with the most traded currency pairs in forex, mistakes happen.

Avoid:

- Overtrading high volatility

- Ignoring economic calendars

- Trading during low-liquidity sessions

- Using excessive leverage

Popularity does not eliminate risk.

Do Most Traded Currency Pairs Guarantee Profits?

No.

High liquidity improves conditions, but:

- Poor risk management still leads to losses

- Emotional trading remains dangerous

- Strategy matters more than the pair

The most traded currency pairs in forex offer opportunity, not guarantees.

Frequently Asked Questions

What is the most traded currency pair in forex?

EUR/USD is the most traded currency pair globally.

Are major pairs better than exotic pairs?

Yes, especially for beginners due to lower risk and tighter spreads.

Can beginners trade all major pairs?

Yes, but starting with one or two is recommended.

Final Verdict

The most traded currency pairs in forex dominate the market for a reason. They offer unmatched liquidity, lower costs, and more reliable price behavior. These pairs are where institutions operate, where spreads are tight, and where strategies perform best.

If you want consistency, clarity, and efficiency in forex trading, focus on the most traded currency pairs first. Master them before exploring anything else.Forex rewards traders who trade where the market actually is.